This fact sheet provides information regarding the support available to businesses in response to the disruption caused by COVID-19. It is organised into the following sections:

Section 1. Federal Government Support

Section 2. Victorian Government Support

Section 3. Other Support

Section 4. Restrictions on Operations

Section 1. Federal Government Support

CORONAVIRUS APP

A coronavirus app and WhatsApp channel have been released by the Commonwealth Government. The app is available on Apple and Android devices. The WhatsApp channel can be accessed by entering aus.gov.au/whatsapp into your internet browser.

This platform provides a trusted source of information for Australians looking for important advice on how they can protect themselves and others, current restrictions on social gatherings, how they can access support and the latest data on Australian cases.

The app also allows Australians to voluntarily register if they are self-isolating to provide governments with important information to protect public health and safety.

HELPLINE FOR SMALL BUSINESSES IMPACTED BY COVID-19

The Federal Government’s Business Hotline - 13 28 46 - has been expanded to provide specialist advisers and extended hours to support small and medium businesses impacted by the COVID-19 pandemic.

The hotline is available to provide businesses readily available access to advice so they can fully understand the assistance available to them and their employees.

This service is available to provide support seven days per week, and provide an additional two hours a day of support outside standard operating hours for the first month, answering calls from 7.00 am to 11.00pm AEST.

SUPPORT FOR BUSINESS CASH FLOW

The Federal Government is providing up to $100,000 over two quarters to eligible small and medium sized businesses, and not-for-profits (NFPs) (including charities) that employ people. These payments will help businesses and NFPs with their cash flow so they can keep operating, pay their rent, electricity and other bills and retain staff.

Who:

• Small and medium sized businesses, including not-for-profit organisations, that employ people and have an aggregated annual turnover up to $50 million will be eligible.

What:

• Employers will receive a first round payment equal to 100 per cent of their salary and wages withheld, with the maximum payment now set at $50,000.

• The minimum payment is now $10,000.

• A second round payment of the same value will be introduced for the July-October 2020 period for those who were eligible to receive a payment in the first round, provided the business or entity is still active.

How:

The payment will be delivered by the ATO as an automatic credit in the activity statement system from 28 April 2020 upon employers lodging eligible upcoming activity statements. The payments are tax-free and employers will not need to complete paperwork in addition to their normal activity statement.

• Eligible employers that withhold tax to the ATO on their employees’ salary and wages will receive a payment equal to 100 per cent of the amount withheld, up to a maximum payment of $50,000.

Eligible employers that pay salary and wages will receive a minimum payment of $10,000, even if they are not required to withhold tax.

ACCESS TO CREDIT

Guarantee Scheme

Participating lenders to small and medium-sized enterprises (SMEs) will have loans guaranteed by government. This guarantee is worth 50 per cent to SME lenders for new unsecured loans to be used for working capital. This will enhance these lenders’ willingness and ability to provide credit, which will result in SMEs being able to access additional funding to help support them through the upcoming months. SMEs with a turnover of up to $50 million will be eligible to receive these loans and the size of the loan is a maximum of $250,000.

Credit Enhancement

The Government is providing an exemption from responsible lending obligations for lenders providing credit to existing small business customers. This exemption is for six months, and

applies to any credit for business purposes, including new credit, credit limit increases and credit variations and restructures. By providing a temporary exemption from responsible lending obligations, this reform will help small businesses get access to credit quickly and efficiently.

For more information on access to credit measures, please click here for the fact sheet.

OTHER SUPPORT FOR BUSINESS

Changes to insolvency and bankruptcy

The Federal Government will implement changes to laws and regulations that govern business practices to ensure that businesses do not go under from being unable to meet their obligations due to complications arising from COVID-19. This includes changes to insolvency proceedings, changes to bankruptcy proceedings and changes to directors’ personal liability. For more information, see this fact sheet from the Federal Government.

Land tax deferral

This is assistance provided by the Victorian Government. For more information, see section on Victorian Government Support on page 6.

Assets and depreciation changes

Your business may be eligible for other assistance to support business investment and business capacity. See sections pertaining to the Instant Asset Write-Off and accelerated depreciation on page 4.

SUPPORT WITH AND FOR EMPLOYEES

JobKeeper Payment

A JobKeeper Payment is now available to provide businesses impacted by the Coronavirus access to a wage subsidy from the Government to continue paying their employees. More related to this scheme can be found on this fact sheet.

Affected employers will be able to claim a fortnightly payment of $1,500 per eligible employee from 30 March 2020, for a maximum of 6 months. Eligible employees will receive a minimum of $1,500 per fortnight, before tax.

Employers will be eligible for the subsidy if:

• their business has a turnover of less than $1 billion and their turnover will be reduced by more than 30 per cent relative to a comparable period a year ago (of at least a month); or

• their business has a turnover of $1 billion or more and their turnover will be reduced by more than 50 per cent relative to a comparable period a year ago (of at least a month); and

• the business is not subject to the Major Bank Levy.

The employer must have been in an employment relationship with eligible employees as at 1 March 2020, and confirm that each eligible employee is currently engaged in order to receive JobKeeper Payments.

Not-for-profit entities (including charities) and self-employed individuals (businesses without employees) that meet the turnover tests that apply for businesses are eligible to apply for JobKeeper Payments.

Business with employees and without employees (self-employed) can register interested applying for JobKeeper Payments. To register interest in JobKeeper Payments employers should submit an online form at:

https://www.ato.gov.au/Job-keeper-payment/. Apprentices and trainees

The Federal Government is supporting small business to retain their apprentices and trainees.

Who:

• The subsidy will be available to small businesses employing fewer than 20 full-time employees who retain an apprentice or trainee. The apprentice or trainee must have been in training with a small business as at 1 March 2020.

• Employers of any size and Group Training Organisations that re-engage an eligible out-of-trade apprentice or trainee will also be eligible for the subsidy.

What:

• Eligible employers can apply for a wage subsidy of 50 per cent of the apprentice’s or trainee’s wage paid during the 9 months from 1 January 2020 to 30 September 2020.

• Where a small business is not able to retain an apprentice, the subsidy will be available to a new employer.

• Employers will be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter).

How:

• Employers will be able to access the subsidy after an eligibility assessment is undertaken by an Australian Apprenticeship Support Network (AASN) provider.

• Employers can register for the subsidy from early April 2020. Final claims for payment must be lodged by 31 December 2020.

• For further information on how to apply for the subsidy, including information on eligibility, contact an Australian Apprenticeship Support Network (AASN) provider.

Payroll tax rebates

This is assistance provided by the Victorian Government. For more information, see section on Victorian Government Support on page 5.

Federal Government assistance payments and income support for workers

The Federal Government has announced a range of supplements, new payments and changes to eligibility requirement to reflect that employees who are stood down or have their work reduced require support with their income.

People who do not already receive a payment from the federal government may receive one of the following: Youth Allowance as a job seeker, JobSeeker Payment and Parenting Payment. The usual waiting periods and mutual obligation requirements may not apply. For further information, please visit Services Australia.

People who already receive a payment from the federal government may experience additional supplements or higher rates of the payments they already receive. For further information, please visit Services Australia.

Those who are eligible for payments through either of the above categories, or who can show they are otherwise employed but currently experiencing reduced income due to the nature of their work, may also be able to apply for up to $20,000 from their superannuation accounts over two years. Applications are made to the ATO. For more information, please see this Fact Sheet from the Federal Government.

SUPPORT FOR SOLE TRADERS

JobKeeper payments

A JobKeeper Payment is now available to provide businesses impacted by the Coronavirus access to a wage subsidy from the Federal Government. Sole traders may be eligible for this payment. More information related to this scheme can be found on page 3 of this document and on this Federal Government fact sheet.

Early access to superannuation

As sole traders may be experiencing reduced income to their business as a result of COVID-19, they may require access to an additional income stream. Sole traders are able to self-certify that their turnover has reduced by 20 per cent or more and apply to access a fixed amount of the superannuation, as above. This is only optional, not compulsory. For more information, please see this Fact Sheet from the Federal Government.

Instant asset-write off

Who:

The Federal Government is expanding access to the Instant Asset Write-Off (IAWO) to include all businesses with aggregated annual turnover of less than $500 million, up from $50 million.

What:

The IAWO threshold will be increased from $30,000 to $150,000. This allows businesses to immediately deduct purchases of eligible assets each costing less than $150,000. The threshold applies on a per asset basis, so eligible businesses can immediately write-off multiple assets.

Note: These arrangements apply until 30 June 2020. The IAWO is due to revert to $1,000 for small businesses (turnover less than $10 million) from 1 July 2020.

How:

This benefit can be claimed through ordinary reporting to the Tax Office for corporate taxation purposes.

Enhanced depreciation measures

Who:

Eligibility applies to businesses with aggregated turnover below $500 million purchasing certain new depreciable assets.

What: A deduction of 50 per cent of the cost of an eligible asset on installation, with existing depreciation rules applying to the balance of the asset’s cost. This applies to new assets that can be depreciated under Division 40 of the Income Tax Assessment Act 1997 (i.e. plant, equipment and specified intangible assets, such as patents) acquired after 12 March 2020 and first used or installed by 30 June 2021. Does not apply to second-hand Division 40 assets, or buildings and other capital works depreciable under Division 43.

How: This benefit can be claimed through ordinary reporting to the Tax Office for corporate taxation purposes.

Section 2. Victorian Government Support

Business Hotline – 13 22 15

The Victorian Government has launched a hotline for businesses dealing with the significant challenges posed by the COVID-19 outbreak.

Businesses across the state can now access information on dealing with COVID-19 by calling the Business Victoria hotline on 13 22 15.

Operators calling the hotline will be able to get information about support services, including those available through Business Victoria, which offers mentoring to help operators develop business continuity and recovery plans.

Payroll Tax Relief

The Victorian Government will provide full payroll tax refunds for the 2019-20 financial year to small and medium-sized businesses with a payroll of less than $3 million.

The Victorian Government has indicated that these payments will start flowing immediately.

The assistance is a refund, not a loan.

Eligible businesses will also be able to defer any payroll tax for the first three months of the 2020/21 financial year until 1 January 2021.

More information about the administration of these relief measures will be sent directly to eligible businesses by the State Revenue Office.

Rent relief for tenants of Victorian Government buildings

Commercial tenants in Victorian Government buildings can apply for rent relief.

Land tax payments

Land tax payments for 2020 will be deferred for eligible small businesses. Land owners due to pay 2020 land tax that have at least one non-residential property and total taxable landholdings below $1 million have the option of deferring their 2020 land tax payment until after 31 December 2020. If an eligible land owner has already paid their 2020 land tax they can request a return of the tax paid.

The State Revenue Office will contact all taxpayers who are eligible for this deferral.

Outstanding invoice payments by the Victorian Government

The Victorian Government will pay all outstanding supplier invoices within five business days. The private sector is being urged to do the same where possible.

Liquor licensing fees

The Victorian Government will waive liquor licensing fees for 2020 for affected venues and small businesses.

The State Revenue Office will administer the reimbursement, regardless of whether the license fee was paid to it or the Victorian Commission for Gaming and Liquor Regulation.

Business Support Fund

The Victorian Government will establish a Business Support Fund. The fund will support the hardest hit sectors including hospitality, tourism, accommodation, arts and entertainment, and retail.

The Victorian Government will work with the Victorian Chamber of Commerce and Industry, Australian Hotels Association and Ai Group to administer the fund.

The fund is targeted at helping businesses survive and keep people in work that may not be eligible for payroll tax refunds due to their size.

Working for Victoria Fund

The Victorian Government will establish a Working for Victoria Fund in consultation with the Victorian Council of Social Services and Victorian Trades Hall Council.

The fund will help workers who have lost their jobs find new opportunities including work cleaning public infrastructure or delivering food – providing vital contributions to our state’s response to the pandemic and affording those Victorians security when it’s needed most.

Job matching services

The Victorian Government will facilitate job matching to help Victorians find short-term or casual roles.

Section 3. Other Support

Mental health support

While it is reasonable for people to be concerned about the outbreak of coronavirus, try to remember that medical, scientific and public health experts around the world are working hard to contain the virus, treat those affected and develop a vaccine as quickly as possible.

The mental health of employers and workers is critical during this period of significant disruption by coronavirus, and support is available.

Lifeline is a national charity open to all Australians in personal crisis. They have 24 hour crisis support and suicide prevention services.

http://www.lifeline.org.au/ Headspace is the national youth mental health foundation. They can help young people who are going through a tough time.

http://www.headspace.org.au/ Support for business from banks

Australian banks through the Australian Banking Association have announced its member banks – which include ANZ, Commonwealth Bank, NAB and Westpac – have announced that they will defer loan repayments for businesses affected by the coronavirus. This applies to businesses who have business loans with a member bank, where the value of the loan is up to $10 million. This threshold covers around 98% of businesses.

In addition to deferral of loan repayments, other measures your business may be eligible for include:

• Waiving fees and charges

• Interest free periods or no interest rate increases

• Debt consolidation to help make repayments more manageable.

For more information about the ABA’s announcement, click here. Businesses should contact their banks directly on the numbers below to discuss their circumstances and access support.

ANZ: 1800 351 548 Commonwealth Bank: 132 607 NAB: 1300 769 650 Westpac: 132 142

Business continuity and recovery plans

Best practice for businesses is to have a continuity plan. Business Victoria has information to help your business evaluate risk and prepare a risk management plan.

Once the initial damage assessment has been done on your business, you need to think about what you'll do long term and how you might respond and recover.

Small Business Victoria provides low cost mentoring services to help you work through or develop a recovery plan. You can book an appointment with a mentor here.

CPA Australia has developed some high-level tips to help businesses respond to COVID-19, including staying up-to-date with information, considering the potential impacts on your business, putting a contingency plan in place and seeking professional advice if required.

The Federal Government’s Coronavirus Business Liaison Unit is now operating out of the federal Treasury This email address is being protected from spambots. You need JavaScript enabled to view it.;

Employer obligations under Fair Work

Whether the option of standing down employees is available in circumstances relating to coronavirus is very fact dependent and an employer should exercise the option cautiously. The employer must be able to demonstrate that:

• there is a stoppage of work

• the employees to be stood down cannot be usefully employed (which is not limited to the work an employee usually performs)

• the cause of the stoppage must also be one that the employer cannot reasonably be held responsible for.

Employers cannot generally stand down employees simply because of a deterioration of business conditions or because an employee has coronavirus.

For more information, see the FairWork Ombudsman’s Coronavirus advice.

Commercial tenancies

National Cabinet agreed to a moratorium on evictions over the next six months for commercial tenancies in financial distress who are unable to meet their commitments due to the impact of coronavirus.

Commercial tenants, landlords and financial institutions are encouraged to sit down together to find a way through to ensure that businesses can survive and be there on the other side.

As part of this, National Cabinet agreed to a common set of principles, endorsed by Treasurers, to underpin and govern intervention to aid commercial tenancies as follows:

• a short term, temporary moratorium on eviction for non-payment of rent to be applied across commercial tenancies impacted by severe rental distress due to coronavirus;

• tenants and landlords are encouraged to agree on rent relief or temporary amendments to the lease;

• the reduction or waiver of rental payment for a defined period for impacted tenants;

• the ability for tenants to terminate leases and/or seek mediation or conciliation on the grounds of financial distress;

• commercial property owners should ensure that any benefits received in respect of their properties should also benefit their tenants in proportion to the economic impact caused by coronavirus;

• landlords and tenants not significantly affected by coronavirus are expected to honour their lease and rental agreements; and

• cost-sharing or deferral of losses between landlords and tenants, with Commonwealth, state and territory governments, local government and financial institutions to consider mechanisms to provide assistance.

Bank assistance to commercial landlords

Commercial property landlords may be eligible for relief from their bank per the ABA assistance package detailed on pages 7-8 as long as they provide an undertaking to the bank that for the period of the interest capitalisation, the landlord will not terminate leases or evict current tenants for rent arrears as a result of COVID-19.

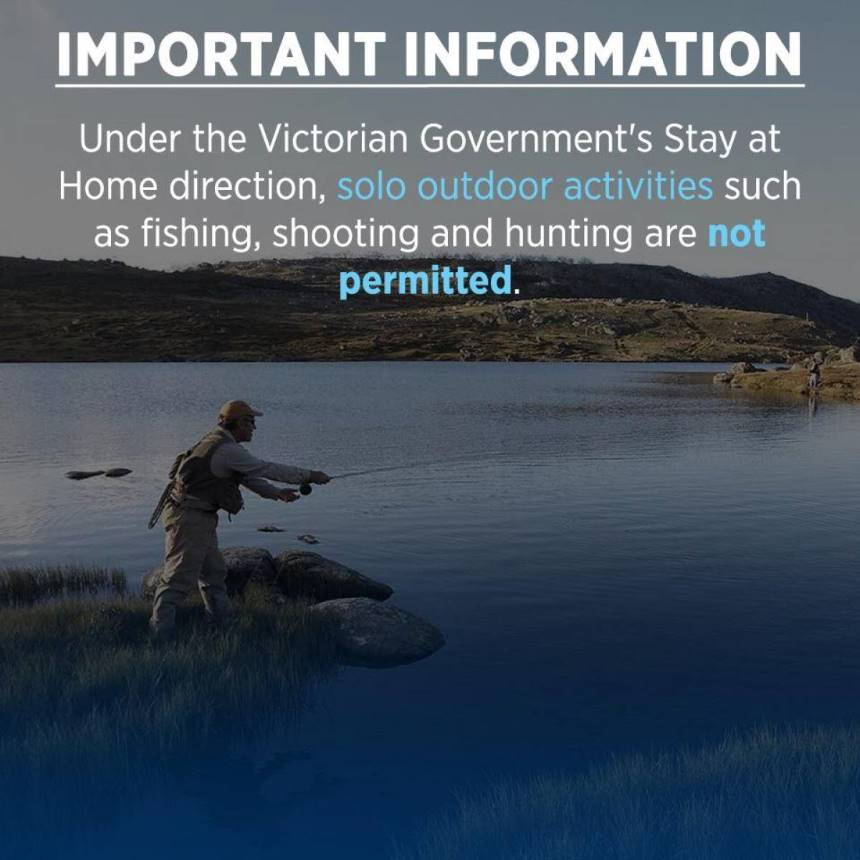

Section 4. Restrictions on operations

All businesses should continue to monitor government advice to ensure they are up to date with rules related to mass gathering and social distancing.

Restrictions on business operations

Current 31st March 2020 and enforced until 13th April 2020 unless otherwise extended.

If your business is not explicitly restricted by this list

Open retail facilities must still follow rules.

• Follow a density quotient (1 person per 4 square metres) and provide signage and directions to customers about the maximum number permitted

• Clean surfaces at least twice on any given day, clean any surface when visibly soiled and immediately clean after spills. These cleaning products must either have anti-viral properties as specified on the packaging, or in keeping with instructions issued by DHHS.

•

Pubs, bars, clubs, nightclubs and hotels

These licensed premises must not be operated except for those aspects of the premises which relate to:

• Operating a bottleshop

• Providing food or drink to be consumed elsewhere

• Providing accommodation

Recreational facilities

These premises must not be operated:

• Indoor physical recreation e.g. gym, indoor pool, health club and fitness centre, yoga studios, bathhouses and things of this nature

• Outdoor physical recreation e.g. mini-golf centre, paintball centre, lawn bowling green, equestrian centre, rifle range and things of this nature even if density and social distancing are otherwise followed

• Personal training facility

• Community centre or community hall

• Library and toy library

• Gallery or museum

• Youth centre and play centre

• Outdoor communal gym equipment, skate parks and playgrounds in parks

Except:

• Where a recreational facility is operated solely for the purpose of an essential public service e.g. food bank or service for homeless persons

• OR a wedding with maximum 5 persons, or a funeral with maximum 10 persons. Social distancing rules must be followed in these circumstances

• Personal training or boot camps may be continued outdoors and on a one-on-one basis (trainer and client)

• Outdoor tennis and outdoor basketball courts may operate provided there is only one court in use at all times, and balls or racquets are not provided for communal use.

Entertainment facilities

These premises must not be operated:

Theatres, cinemas, music and concert halls, auditoriums

Arenas, stadiums and convention centres

Arcades and amusement parks

Casinos and gambling businesses

Adult services including brothels, sex-on-premises venues, strip clubs, escort services or other adult entertainment venue

Exceptions:

• The above may be operated for the purpose of allowing a recorded performance to occur where the only persons in attendance are those required for the performance

Places of worship

These premises, of any kind, must not operate except in the following circumstances:

• The facility is being used for a wedding (maximum 5 people) or funeral (maximum 10 guests)

• The facility is being used to host an essential public service e.g. a foodbank or service for homeless persons

Restricted retail facilities

These premises must not operate:

• A beauty and personal care facility, such as those providing beauty therapy, waxing, nail services, a spa, massage parlours (non-medical massage), tattoos. These MAY operate for the purposes of providing, by delivery or collection, goods to a person’s private residence.

• An auction house (other than to conduct auctions remotely)

• A market stall, indoor or outdoor (other than where the market stall where the primary purpose is to provide food and drink for consumption elsewhere AND social distancing and density requirements are followed)

• All firearms transactions including the sale, hire and loan of firearms and the sale of ammunition for the reasons of Sport or Target Shooting, Clay Target Shooting and Recreational Hunting are prohibited. Those transactions that related to genuine occupational usage remain unaffected.

Food and drink facilities

These include cafes, restaurants, fast-food stores, cafeterias and canteens and can only operate under these circumstances:

• For the purpose of delivery and collection of take-away food, and where that food will be consumed elsewhere

• Where the purpose is to provide food or drink to homeless persons

• If the facility is part of the food provision services of a hospital, residential aged care facility, school, place of custody or defence location

Accommodation facilities

These, which include camping grounds and caravan parks, must not operate except:

• Where a person is an ordinary resident, or is an ordinary resident of Victoria but has no fixed address

• Where a person’s ordinary residence is temporarily unavailable

• Where a person requires emergency accommodation

Swimming pools

A person in charge of a premises where there is a swimming pool must not permit any person to use it, including public pools and private pools for communal use. This excludes where a pool is at a private residence and not available for communal use.

Animal facilities

Exceptions apply for animal care, animal rescue and facility maintenance, but the following animal facilities are not permitted to operate:

• Zoos

• Wildlife centres

• Petting zoos

• Aquariums

• Animal farms that are not for the purpose of producing food

Real estate auctions and inspections

An estate agent must not organise any auction (other than remotely) to take place, or any inspection of a residential property (other than by private appointment) for the purpose of a sale or leasing.

Visit coronavirus.vic.gov.au for the latest updates – issued daily – and additional stages of non-essential activity closure.